The following is a peek into various metrics and indications regarding the consumer drone industry. Specifically, we attempt to show a general slowdown in the consumer drone growth curve and more specifically indications that a “dot-drone” bust is already underway and may accelerate in 2016.

We will focus on 3D Robotics which we believe to be indicative of “boom-bust” part of the cycle due to their having received the largest amount of Venture Capital of any consumer drone startup. Some mention will also be made of DJI and others – in order to properly frame the discussion.

Firstly, none of this is either new – nor a surprise. Frank Wang, the founder of DJI (with 80% of the camera/drone mid-range market) clearly stated that this was going to become a low priced and low-margin business AND that he (DJI) was likely to squash any competitors.

“I believe this industry…will (sic) become low-margin… But that all depends on DJI’s pace. If DJI wants the industry to be low-margin, it will be low-margin. We must be extremely aggressive going forward.”

Not much wiggle room in there!

“Our goal is to maintain 100% growth in sales in the next two years… If we can do that, I believe we will have 90% of the market.”

Again, that leaves only 10% for the combined other players in the drone biz!

And, even more specifically, Frank Wang on 3D Robotics chances of success:

“It’s easier for them to fail”

“They (now) have money, but I have even more money and am bigger and have more people.”

“When the market was small, they were small and I was small, too, and I beat them.”

Mr. Wang seems to have a decent grasp of business and the markets he serves. At the same time, even he may be wrong about DJI’s 2015 growth – which was slated to have the company pass 1 billion dollars in annual sales (2X 2014 sales). Although this is certainly possible, our take is that negative press on drones and other factors will have DJI falling short of that number – 800 million in our projections.

3D Robotics is a different story altogether.

The charts in this article help buttress our speculation in our other article named “Is 3D Robotics Falling from the Sky?”

Their CEO and promise/projections called for a 500% increase over 2014 revenues which were reported (INC Magazine and others) to be at approx. 20 million dollars. This would mean 100+ million dollars in 2015. Others guessed at 40-50 million on the low end while the CRO of 3DR (Colin Guinn) claimed he might sell 100,000 units in calendar 2015 – which would likely mean up to 80+ million in revenue.

3DR does not share sales numbers but our educated guess is approx. 20K Solo units sold. If we assign $1,000 in revenue to each, that would be 20 million dollars. Add in another 10 million for their legacy products (probably a high estimate) and you have 30 million dollars – far below any of those more wild projections.

Here are our estimates and how we came to them….

2015 Revenues (actually collected) – $30-35 million in total revenue – note, this is actual gross income net of returns and bad debts and

Sales figures on the Solo drones are based on various sources in the investment community who have reported them quasi-publically (online forums, other discussions). More importantly, they perfectly dovetail with the lack of Solo owners in online forums as well as google trends and other metrics. See below:

DIYDRONES.COM was/is the launchpad for 3DR – it’s a forum launched and run by 3DR CEO Chris Andersen and is championed as the leading drone forums on the internet. Yet their traffic has decreased constantly as drones have become more and more popular! Notice the slight downward trend of the chart.

A Solo sub-forum was started on this popular web site – and yet there is very little action in that discussion group. The graphics above illustrate two points.

1. The DIY portion of this hobby which 3DR catered to is declining. While there are probably 10X as many people interested in drones as 2-3 years ago, DIYDRONES.COM traffic is actually declining and 3DR recently discontinued ALL of their existing legacy products – making them effectively a one product company (Solo).

2. Buyers and users of the Solo are not a large enough community to sustain a conversation…even on the site which relates most closely to their product.

We have also followed a few other sites where 3DR Solo owners might go to get information on their machines. Keep in mind that most drone pilots DO get a lot of their information and support online.

Amazon.com Holiday Rankings

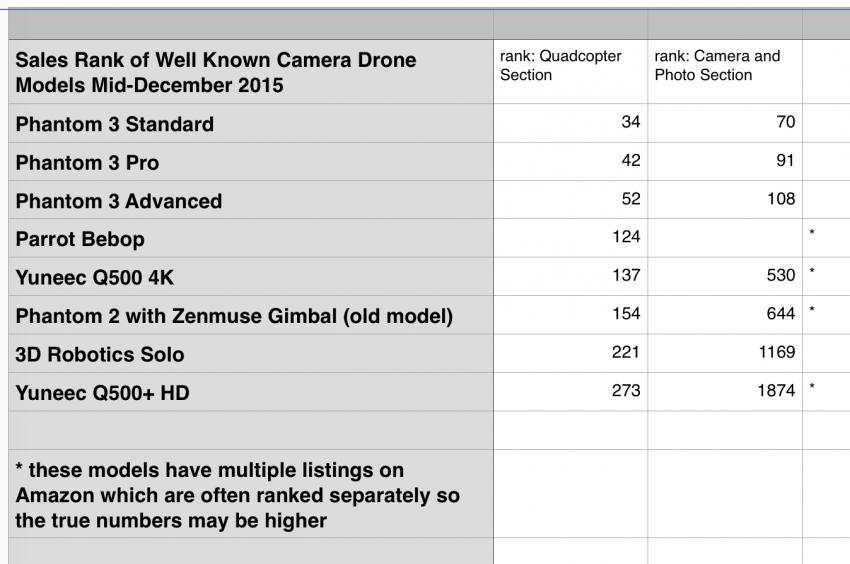

Amazon sales figures provide a peek into sales of most popular products. After all, a large % of us do our shopping online these days so the relative sales ranks are probably a good indication of the public acceptance of various drone models. These ratings are updated hourly and we have been studying them for weeks…

This chart shows poor Solo sales on Amazon. It is being outsold by Yuneec and the Parrot BeBop and not even in the same league as the DJI models. In fact, it trails a old (discontinued?) model of the DJI Phantom 2.

Another brand new and largely unknown model, the Xiro Xplorer, is selling approx. on par with the 3DR Solo (Xiro not shown in numbers above).

If Amazon sales mean anything – and we think they do – this is not good news for 3DR.

NOTE: These numbers are dynamic and even the Solo may be reported as “with gimbal” and “without gimbal” separately. However, this is true of most all of the others – sometimes even more so (multiple listings of same product).

Google Trends

Google provides an insight into the popularity of all search terms. Here are some examples of charts relating to 3DR.

Above shows interest in 3D Robotics.As you can see it built up slowly and peaked in April with the announcement of the Solo Drone. It has trended down since.

Above is a chart on the general term “Camera Drones” – this shows the upward slope of interest – and it would make sense that interest in the top brands would be on a similar upward trajectory.

This Chart is specific to the Solo – and again shows the instant and high peak on launch and declining interest since. It would seem that a product which is going into more and more hands and stores would see increased search over time….

And the following seems to prove the point.

Yuneec is a newer entry to the world of drones and their trending seems to fit with interest that is slowly building up and staying high during the Holiday Sales Season – as well it should. This seems more normal.

The above trend chart on the DJI Phantom 3 – this year’s most popular model – seems to confirm that theory – a “trending” model should show an upward tendency.

Lastly, another indication on DIYDRONES, the site which launched 3DR and remains the platform for many of their early fans and developers – and also a blogging and announcement platform for their CEO.

Once again we have a chart that shows declining interest even though DIYDRONES.COM has been mentioned and promoted in large numbers of stories and PR pieces about 3D Robotics and their CEO.

I’m not Nate Silver so cannot state with 99.8% certainty as to what this all points to. However, having had business and internet metrics experience I can state that it DOES MEAN SOMETHING. Together with all the other know facts it points, IMHO, to a company which cannot continue on its current course of high “burn rate” and relatively low revenues.vv

The entire industry may also be entering a period of slower growth – due to bad press, regulation and market saturation. Owners of a newer model of drone such as the Yuneec or the Phantom 3 are probably very satisfied and not standing in line to buy another model.

Large numbers of startups and crowdsourced companies are also likely to run into a wall as they discover how difficult it is to develop a reliable drone – and THEN to sell it at a competitive price and back it with parts, service and warranty. Many Chinese “copy-cat” firms are coming up with models which attempt to steal market share from DJI – but few are getting traction because these model offer no advantages over the existing products.

We opine that the market has shifted due to the release of the Phantom 2 Vision+ (3.0) approx one year ago – and even further since the Phantom 3 line was released in May, 2015. As if that wasn’t enough, DJI released the Phantom 3 Standard which give more capabilities than the P2V+ – at 1/2 the price! This aggressive pace would seem to make it difficult for others to enter the field as development of a new drone can easily take 12-18 months from conception to manufacturing.

Note – corrections and additions welcome. The above is speculation and editorial based on my months of research on 2015 model consumer drone sales. We will continue to reach out to industry insiders, 3DR and others for facts which either confirm or negate our opinions.

The charts in this article help buttress our speculation in our other article named “Is 3D Robotics Falling from the Sky?”

Please use the contact form below to send any information you may have to our attention.

You must be logged in to post a comment.